This update contains the following key quantitative metrics from the

dashboard that are inputs to its investment decisions:Global Liquidity Index vs ₿itcoin

Market Cap 'Flippening' Tracker (₿ Ξ vs TradFi Assets)

Total Crypto Market Cap Logarithmic Trend [Aug 2023]

₿itcoin

Network Value Model

Logarithmic & Linear Regression Models [Aug 2023]

Logarithmic Trend Channel [Aug 2023]

Market State

Ξthereum

Network Value Model

Logarithmic Trend Channel [Aug 2023]

Market State

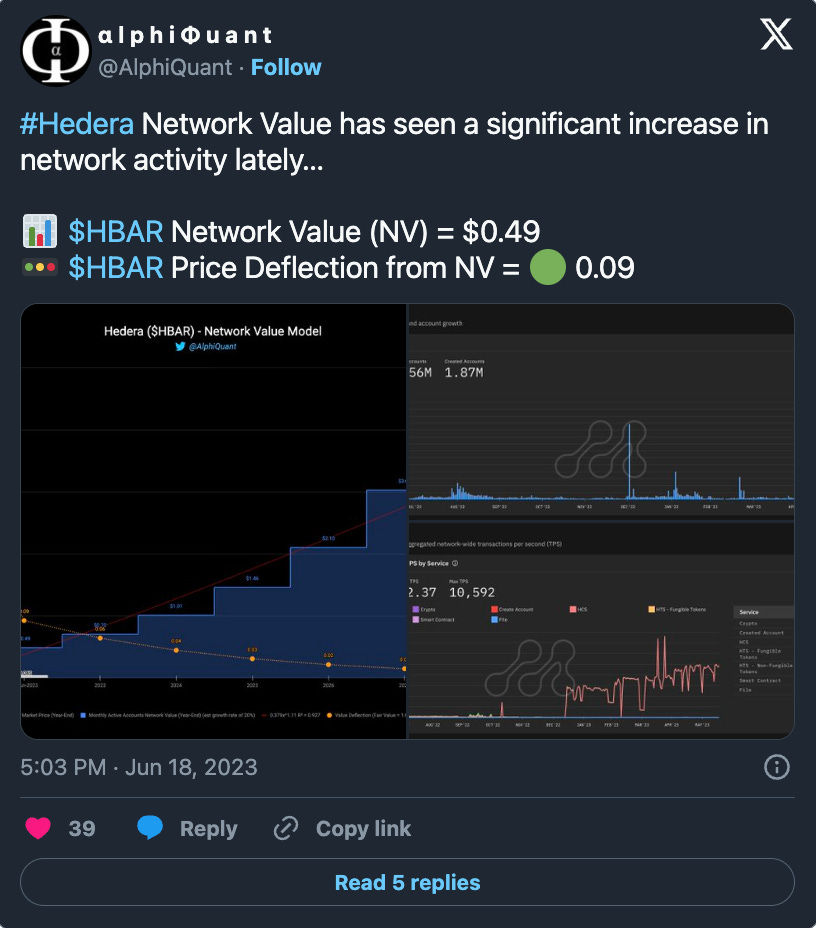

ℏedera Network Value Model

TESLA TSLA 0.00%↑

Network Value Model

Logarithmic Trend Channel [Aug 2023]

Market State

Apple AAPL 0.00%↑

Network Value Model

Logarithmic Trend Channel [Aug 2023]

Market State

Note: This issue is best viewed on Substack instead of email. Click on the charts for the HD versions.

Global Liquidity Index vs $BTC

Global Liquidity Index correlations are similar for $SPX $NDX

Global Liquidity potentially double bottoming

Perhaps a bearish divergence dip before parabolic rally in Technology and Digital Assets

ISM below 50; US manufacturing slowing; possible recession

Click above chart for details

Zooming in via chart below:

Q4 2022 - Bullish Divergence

2023 - Bearish Divergence

tal Crypto Market Cap Logarithmic Trend [Aug 2023]

₿itcoin

₿ Network Value Model (BTCUSD $23,379)

🚥

Deflection (P/NV) = 🔴 1.11 (Fair Value = 1.00)

₿ Logarithmic Regression Model [Aug 2023]

₿ Linear Regression Model [Aug 2023]

₿ Logarithmic Trend [Aug 2023]

₿ Market State

Ξthereum

Ξ Network Value Model (ETHUSD $629)

🚥

Deflection (P/NV) = 🔴 2.60 (Fair Value = 1.00)🥩 Close to 1/4 of $ETH supply is now staked (~ $50 billion) via over 900K validators.

Ξ Logarithmic Trend {Aug 2023]

Ξ Market State

ℏedera Network Value Model (HBARUSD $0.22)

🚥

Deflection (P/NV) = 🟢 0.23 (Fair Value = 1.00)

Note that ℏedera is an altcoin and challenging to model from a data science perspective. The monthly active accounts varies considerably from month to month and hence its NV fluctuates accordingly.

Overall, the expectation is for the NV model to be directionally correct and, during a euphoric market phase, $HBAR to trade at a multiple premium to its NV based on the project’s fundamentals, utility, and narrative.

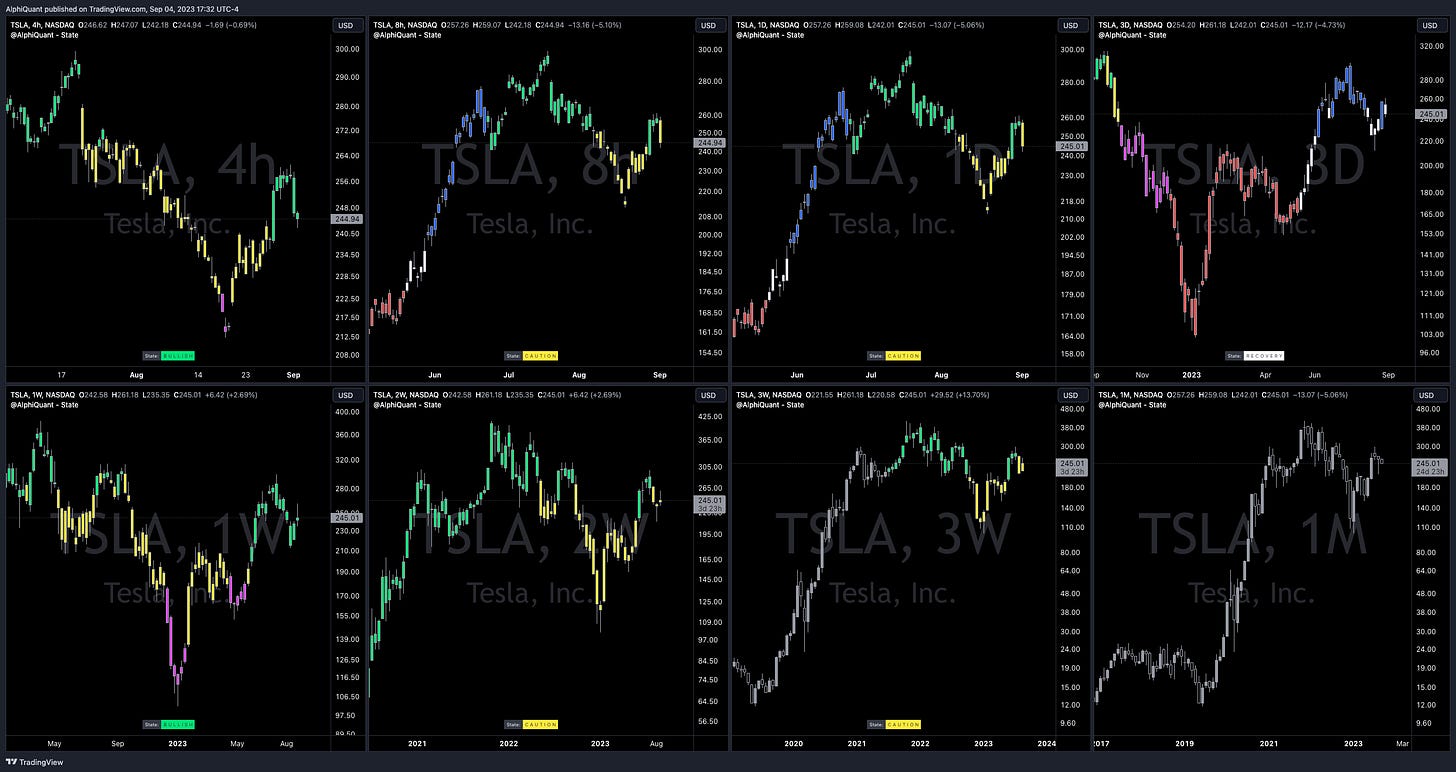

TESLA TSLA 0.00%↑

$TSLA Network Value Model ($728 per share)

📊

Ratio (EV/NV) = 0.29🚥

Deflection (P/NV) = 🟢 0.34 (Fair Value = 1.00)🔌 Enterprise Value per Supercharger = $14 million

💰 Potential ~ 8x ROI by end of 2026

$TSLA Logarithmic Trend [Aug 2023]

$TSLA Market State

Apple AAPL 0.00%↑

$AAPL Network Value Model ($238 per share)

📊

Ratio (EV/NV) = 0.74🚥

Deflection (P/NV) = 🟡 0.79 (Fair Value = 1.00)📱 Enterprise Value per Active iPhone = $2,029

💰 Potential ~ 2x ROI by end of 2026

$AAPL Logarithmic Trend [Aug 2023]

$AAPL Market State

Disclaimer

*** AlphiQuant publishes its research & analysis for purely educational purposes and is not licensed to provide financial advice nor is it registered with any financial regulatory body. Perform your own research and consult your financial advisor for investment advice. ***