Palantir Technologies Financial Data Science Model

Q2 2023: Enterprise Software Platform Network Value

In this issue:

Palantir Quantitative Investment Analysis [Q2 2023]

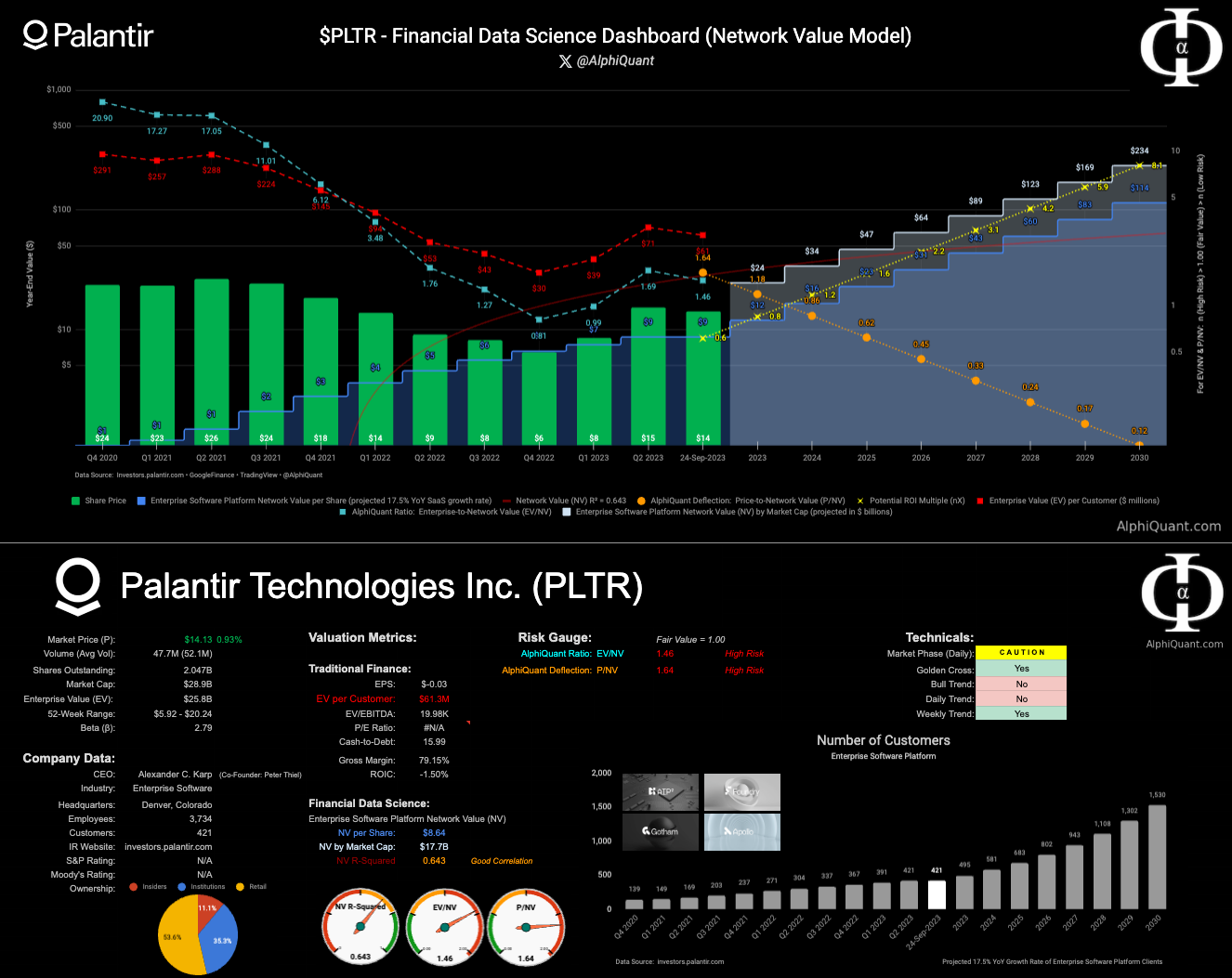

Financial Data Science Dashboard (Network Value Model)

Network Value (NV)

AlphiQuant Ratio (EV/NV)

AlphiQuant Deflection (P/NV)

Enterprise Value (EV) per Customer

Potential ROI by 2030 (based on TAM Penetration Scenarios)

Palantir Technical Analysis (potential buy opportunity)

Palantir Technologies Inc.

Company Profile

Network Effect & Defensibility

Enterprise Software Platform

Quarterly Earnings Update [Q2 2023]

Institutional Ownership [Q2 2023]

Palantir 𝕏 Community Insights

PayPal Mafia

Palantir Quantitative Investment Analysis [Q2 2023]

Financial Data Science Dashboard

Network Value (NV) = $8.64 per Share | $17.7B by Market Cap

AlphiQuant Ratio (EV/NV) = 1.46

AlphiQuant Deflection (P/NV) = 1.64

Enterprise Value (EV) per Customer = $61.3M

PLTR 0.00%↑ is currently overvalued wrt NV; remain patient for more favourable entry point (see Technical Analysis section below)

Note: The PLTR 0.00%↑ financial data science dashboard will be regularly shared on the 𝕏 platform, weekly via Substack, and the Network Value model will be updated quarterly based on Palantir’s earnings reports.

Follow @AlphiQuant on the 𝕏 platform and subscribe to Substack to stay abreast of updates.

Potential ROI by 2030

Total Addressable Market (TAM) ~ 6,000 customers

Anticipated market penetration ~ 25% (approx 1,500 customers)

Projected number of customers growth rate of 17.5% YoY

Palantir has built an AI technological moat that is unparalleled with potential to be a dominant player in the AI revolution over the next decade

Furthermore, there is a high probability this edge in technology translates to prosperous future company financials and the stock goes parabolic.

It’s not out of the realm of possibility that Palantir captures more than 50% of the TAM by 2030

An investment in Palantir can be classified as an asymmetric risk vs reward profile

Palantir Technical Analysis

PLTR 0.00%↑ has potentially developed into a multi-month Head & Shoulders topping pattern

If the pattern plays out, the measured move would be down to the $10 range.

H&S top measured move down would be in general confluence with both the Fibonacci retracement ‘Golden Zone’ as well as the breakout area from the August 2022 high

Targeting the $12-10 accumulation zone (green)

A gift would be the $8-7 potential gap fill zone (blue)

Palantir Technologies Inc.

Company Profile

The Story

Palantir started out with niche government contracts, but since has been engaging in the expansive trend of various industries leveraging recent generative AI innovations to streamline operations and optimize expenditures.

Accelerating growth story in a sector where Palantir can capitalize on its first-movers advantage and is on the cusp of monetizing this massive AI opportunity

In the last 12-18 months, Palantir deployments have become more and more relevant within the commercial enterprise software space and, if you speak with CIOs, its use cases in AI are the gold standard.

Palantir is at an inflection point of transitioning to exponential growth due to the potential expansion of its ecosystem of business partners leveraging its enterprise software AI platform to address their respective industry use cases

Potential to penetrate a significant portion of the total addressable market (TAM) that's estimated to be huge

Company DNA

Palantir is ahead of the game and is well positioned as an execution story that’s a springboard led by AI (provided they have the right sales people, right customers, and right strategy).

GAAP profitable and potential inclusion in S&P 500 on horizon

Recent buyback announcement points to prudent capital allocation as an investor, shows confidence in their story, takes a cue from big tech, all while sending a signal to Wall St that they feel they’re undervalued and growth is coming.

Strategy Transition:

Customer base from government (defence) to enterprise (SaaS)

Technology focus from legacy to next-generation

CEO & Management

Solid management team, including a great CFO, led by a visionary CEO has made significant changes that are now starting to yield results.

Karp is a visionary CEO:

Seen as eccentric, though his vision and success cannot be argued against and it’s a big part of where Palantir is today. Elite CEOs are different (e.g. Musk, Jobs, Bezos, etc).

He's building something unique and you need a different style and leadership like his to accomplish such a task

Karp said they had to teach the market what the problem was and the unique solution Palantir offers (reminiscent of when Steve Jobs was right about Apple having to tell the customer what they wanted)

His philosophical investor letters to shareholders are posted on Palantir’s website

Palantir has developed a premium product and, coupled with management’s vision, is in the process of executing to capture a unique opportunity.

Investor’s Lens (TradFi vs Data Science Valuation Models)

Requires a long term view in terms of macro theme and picking winners within that theme. The AI theme is considered the fourth industrial revolution and biggest technology trend since the Internet. Palantir is viewed as a technological leader and potential winner within this theme.

Looking at P/E ratio will cause investors to miss opportunity as valuations will seem insane (as they do for technology companies that exhibit digital network effects)

Technological vision and insight of how the company can monetize will enable investors to capitalize on opportunity (e.g. akin to Apple, Amazon, Google, Microsoft, Tesla)

Anticipate exponential growth in the future as company monetizes enterprise opportunity (i.e. legacy government vs next-gen enterprise AI)

Utilizing the data science model presented above serves as a directional guide to future value

Retail Leading Institutions & Wall St Analysts

Retail is super early as Palantir is an inflecting growth story that’s just getting started

Institutions are behind retail wrt technology and companies that exhibit digital network effects (think of big tech)

Wall St analysts have a dogmatic view on whether Palantir can deliver on enterprise. They don't understand enterprise software and haven't done the work to understand the technology. They talk about it from strictly a traditional finance valuation standpoint which is antiquated for technology stocks that exhibit digital network effects. It’s more appropriate to value these types of companies using financial data science.

Analysis

These polarizing technology stocks are emotional bull and bear narratives. Remove emotion, rely on independent research, and quantitative analysis (i.e. trust the data science behind the math).

Hated from an institutional perspective

Undiscovered gem from an AI perspective

Commercial enterprise opportunity is way bigger than the government side of things. Wall St always puts a lower multiple on government and values it less. PLTR 0.00%↑ started with government, but is expanding its enterprise footprint.

Reputable technology analyst, Wedbush’s Dan Ives, recently initiated coverage calling Palantir the “The Messi of AI on the golden track to success”. He has stated that this is a 1995 moment akin to the Internet revolution and that this is not hyperbole, but we are at the precipice of this AI revolution. He has a reputation of being early and accurate on the big tech names.

Bear Case

Palantir is unable to monetize the enterprise AI opportunity

Customers question whether Palantir’s technology offerings and Proof-of-Concepts (PoC) actually work and/or whether it’s worth it?

PoC’s don’t prove out customer use cases

Customers think Palantir’s technology offerings are too expensive and that competitors could do it (not as good), but at a significantly less price.

Negative narratives of data stealing, military, political ties, etc (once growth gets into the 20-30% range it will be a moot point)

Some ‘Black Swan’ macro situation that thwarts progress of AI (extremely low probability). Besides, this would just extend the investment timeline as the AI revolution is coming whether people like or not.

Bottom Line

Accomplished as proven AI Enterprise Software Platform

These types of technological companies are transformational trends which can be analyzed in two ways:

Have insight to look out 3-5 years (using data science)

Project out a 'sum of the parts' analysis with different multiples assigned to the following parts of the business:

Legacy Government (low multiple)

Non-AI Enterprise (significant multiple)

AI Enterprise & Government (high multiple)

Going Forward, Palantir Technologies is now well positioned and is a “prove it” execution growth story that needs to be inflecting in the next few quarters (i.e. by mid-2024).

Reference: Dan Ives X Space re: Palantir Technologies ($PLTR)

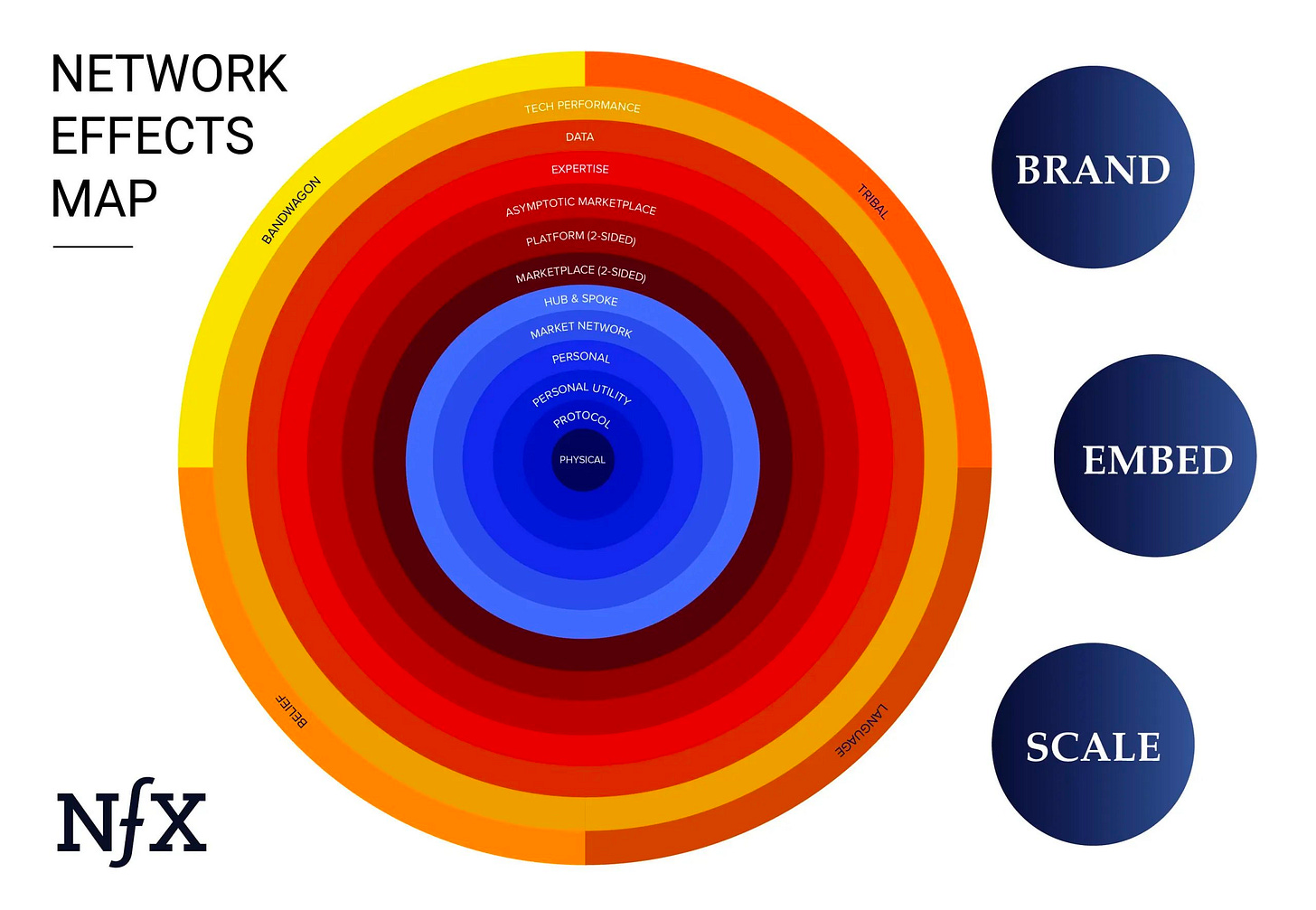

Network Effect & Defensibility

Palantir Technologies is an enterprise network based on its software platform similar to Microsoft or Salesforce

Palantir has potential to become the gold standard in AI for various industries

Palantir Technologies also exhibits data network effects which is a phenomenon where a product or service becomes smarter as it gets more data from its users. The more users use the product, the more data they contribute, and the smarter the product becomes. Palantir gains knowledge about how various industries operate and allows them to create AI templates for these respective industries.

In Ray Dalio’s new book, he says we are moving away from the industrial era where wealth was created from ownerships of land to wealth creation from ownership of data. Data is a liability until converted into an asset through the use of Artificial intelligence.

As more companies use Palantir software to optimize their operations, the more their industry peers will feel compelled to also use Palantir software in order to keep pace with their competitors. For example, once it optimizes operations for one airline, then other airlines will also want to use Palantir to optimize their operations.

Palantir Technologies may be showing early signs of establishing an enterprise software network effect with embed characteristics of defensibility.

Data Science can be used to value PLTR 0.00%↑ based on the number of customers using the platform (akin to active users on a network)

In particular, Metcalfe’s Law can be used to calculate and map the growth of the value of a technology stock or digital asset. The product is going to have some value to the users, but at some point the value of the network exceeds the value of the product reaching critical mass and hence exponential growth ensues.

Financial data science valuation models lead traditional finance valuation models. Thus, digital networks that start small, and then reach the aforementioned inflection point, tend to have financials follow and their stock go parabolic.

Network effects is an entire topic on its own and a detailed write up is coming soon so subscribe to be notified when it’s posted.

Enterprise Software Platform

Artificial Intelligence Platform (AIP)

AIP empowers organizations to use Large Language Models (LLM) and other cutting-edge AI safely and securely.

The platform allows organizations to do three things:

Activate LLMs on a private network with an optimized data foundation. AIP allows organizations to deploy LLMs, and any other AI, within their private network anchored with their private data. It helps create a full fidelity real-time representation of all of the concepts, actions, and decisions within the business that can then be used by AI.

Govern LLMs, defining when they can act alone and where they need human input. Enables organizations to define the ground rules around which data LLMs can and cannot see, and what they can and cannot do, on behalf of humans. The access control can be defined based on data sensitivity, laws and regulations, and competencies of the model. AIP provides the framework for AI to handoff tasks to other trusted task specific models as well as to trust humans.

Monitor & Control LLM Activity. AIP brings industry leading guardrails to control, govern, and trust the AI powered business of tomorrow. AIP automatically captures a full digital footprint of all AI inputs, outputs, and actions including which AI was used for which decision, which humans were in the loop, and how they align with specific business purposes.

In both commercial and government segments, Palantir’s Artificial Intelligence Platform aims to allow customers to harness the power of AI, seamlessly integrating with LLMs to make informed decisions directly in existing platforms: Foundry, Gotham, and Apollo.

Foundry

The Ontology-Powered Operating System for the Modern Enterprise.

Palantir Foundry offers an integrated suite of industry-agnostic capabilities for analysis, collaboration, and operations.

The Foundry Ontology is the heart of Palantir Foundry. It integrates the semantic, kinetic, and dynamic elements of a business — empowering teams to harmonize and automate decision-making in complex settings.

Foundry Digital Twin: Power next-generation operations with semantic data, AI/ML-based twins, and twin-based simulations.

Gotham

The Operating System for Global Decision Making.

Palantir Gotham is a commercially-available, AI-ready operating system that improves and accelerates decisions for operators across roles and all domains.

Gotham’s built-in feedback loops train and refine models that augment human analysis and decision making during operations. In turn, operator actions improve these models over time.

Apollo

The Operating System for Continuous Delivery.

Servers as ‘Mission Control’ for complex software deployments due to security and regulatory demands. From the back of a humvee to the hull of a submarine, Apollo enables continuous deployment across all environments.

Apollo brings years of R&D across advanced deployments into an intelligent platform that is flexible and extensible to companies and their customer’s particular needs.

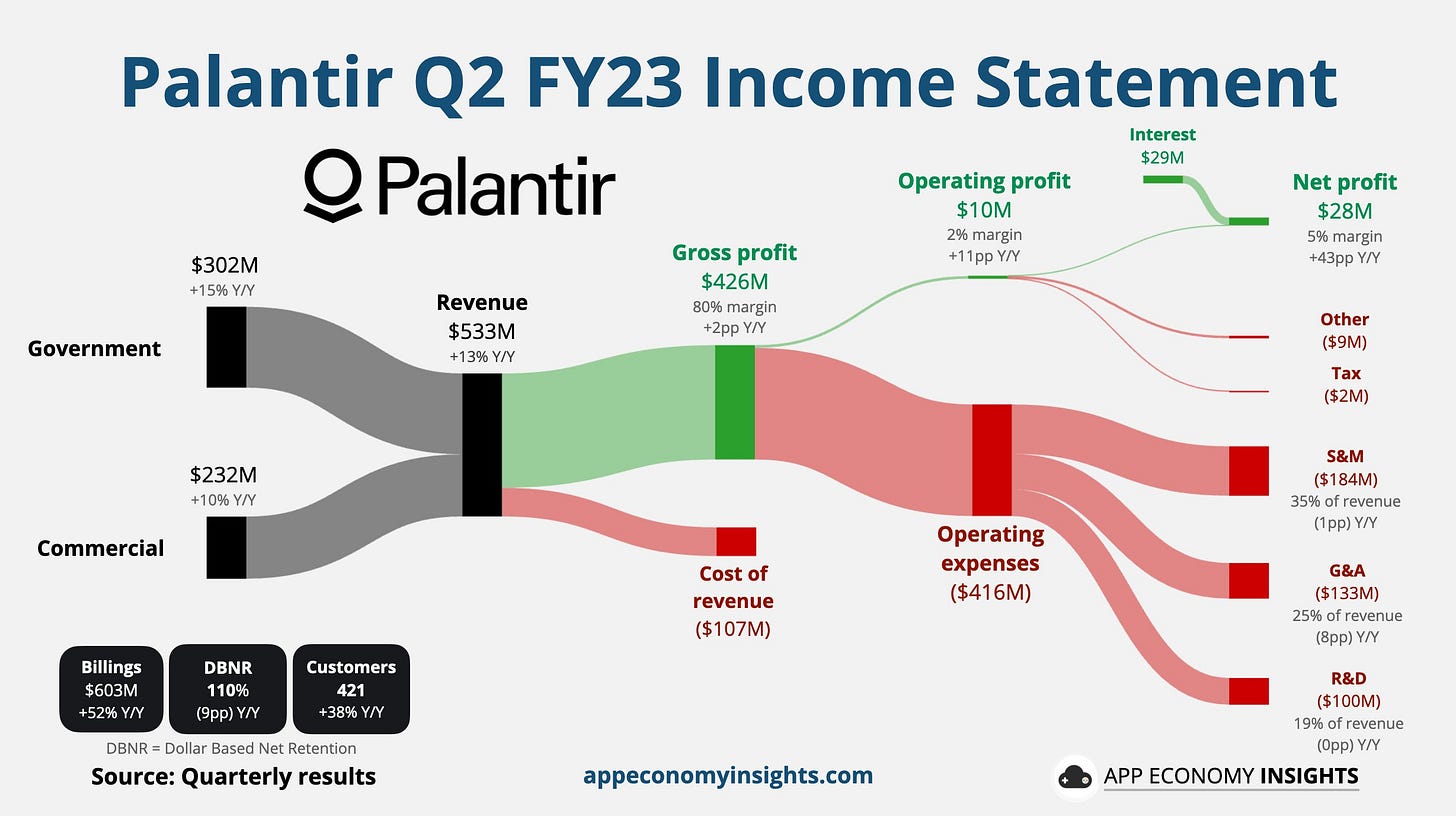

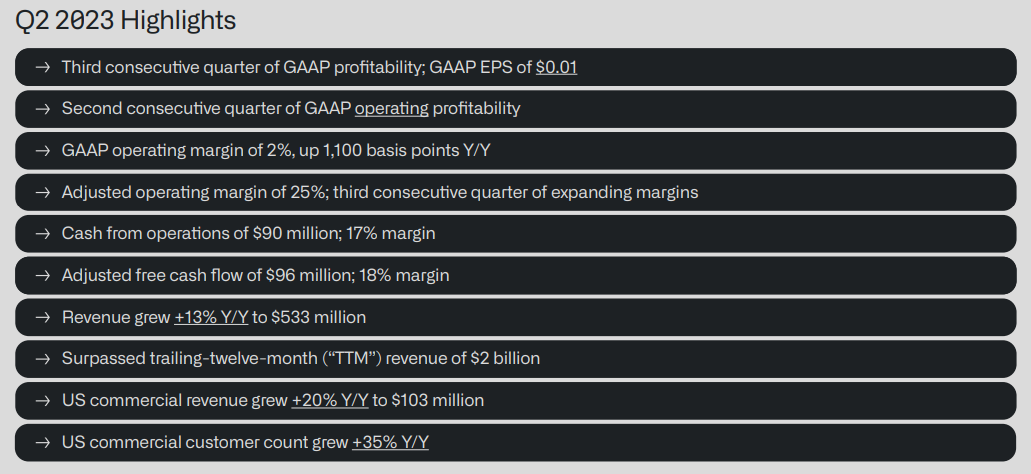

Quarterly Earnings Update [Q2 2023]

Institutional Ownership

Retail has rare opportunity to front-run institutions…

Palantir 𝕏 Community Insights

PLTR 0.00%↑ has a vibrant community on the 𝕏 platform with educational info, stock analysis, valuable insights, and latest news on Palantir Technologies.

The following are examples of the posts that helped me in my journey learning about Palantir Technologies:

PayPal Mafia

Palantir was founded in 2003 by Alex Karp, Peter Thiel, Nathan Gettings, Stephen Cohen, and Joe Lonsdale to provide insight to organizations by collecting, integrating, analyzing, and visualizing vast amounts of data.

Palantir spawns from the ‘PayPal Mafia’ so I’ll conclude by paraphrasing Michael Corleone:

“Don’t ever take sides against the family. Ever.” — Michael Corleone

“There’s a small group who can do the math. There’s an even smaller group that can explain it. But those few who can do both, they become billionaires.”

Bobby Axelrod, CEO

Disclaimer

*** AlphiQuant publishes its research & analysis for purely educational purposes and is not licensed to provide financial advice nor is it registered with any financial regulatory body. Perform your own research and consult your financial advisor for investment advice. ***