Financial Data Science Dashboard

July 2023

This update contains the following key quantitative metrics from the

dashboard that are inputs to its investment decisions:Market Cap 'Flippening' Tracker (₿ Ξ vs TradFi Assets)

Total Crypto Market Cap Logarithmic Trend Channel

₿itcoin

Network Value Model

Logarithmic & Linear Regression Models

Logarithmic Trend Channel

Market State

Ξthereum

Network Value Model

Logarithmic Trend Channel

Market State

ℏedera Network Value Model

TESLA TSLA 0.00%↑

Network Value Model

Logarithmic Trend Channel

Market State

Apple AAPL 0.00%↑

Network Value Model

Logarithmic Trend Channel

Market State

Total Crypto Market Cap Logarithmic Trend Channel

₿itcoin

₿ Network Value Model (BTCUSD $23,111)

🚥 $BTC Value Deflection = 🔴 1.25 (Fair Value = 1.00)

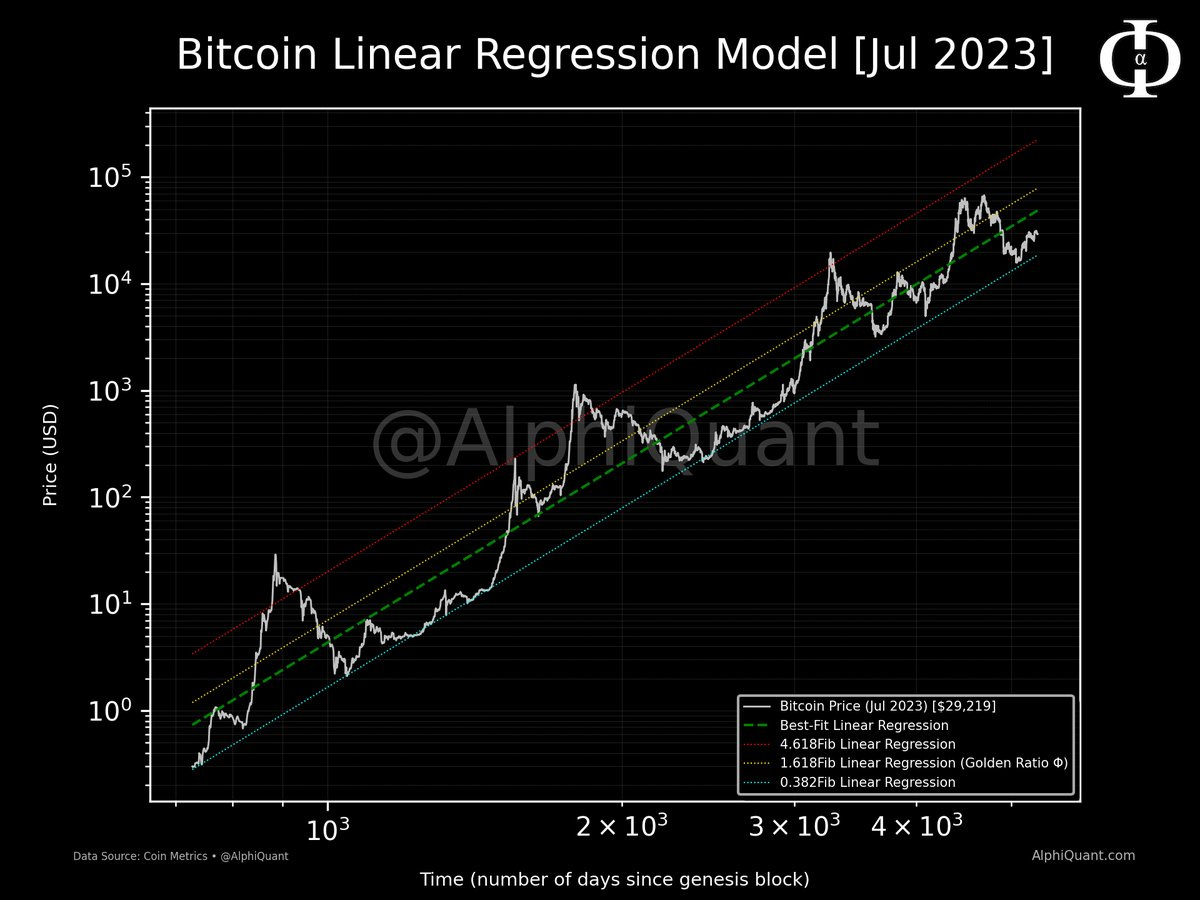

₿ Logarithmic Regression Model

₿ Linear Regression Model

₿ Logarithmic Trend Channel

₿ Market State

Ξthereum

Ξ Network Value Model (ETHUSD $614)

🚥 $ETH Value Deflection = 🔴 2.97 (Fair Value = 1.00)

Ξ Logarithmic Trend Channel

Ξ Market State

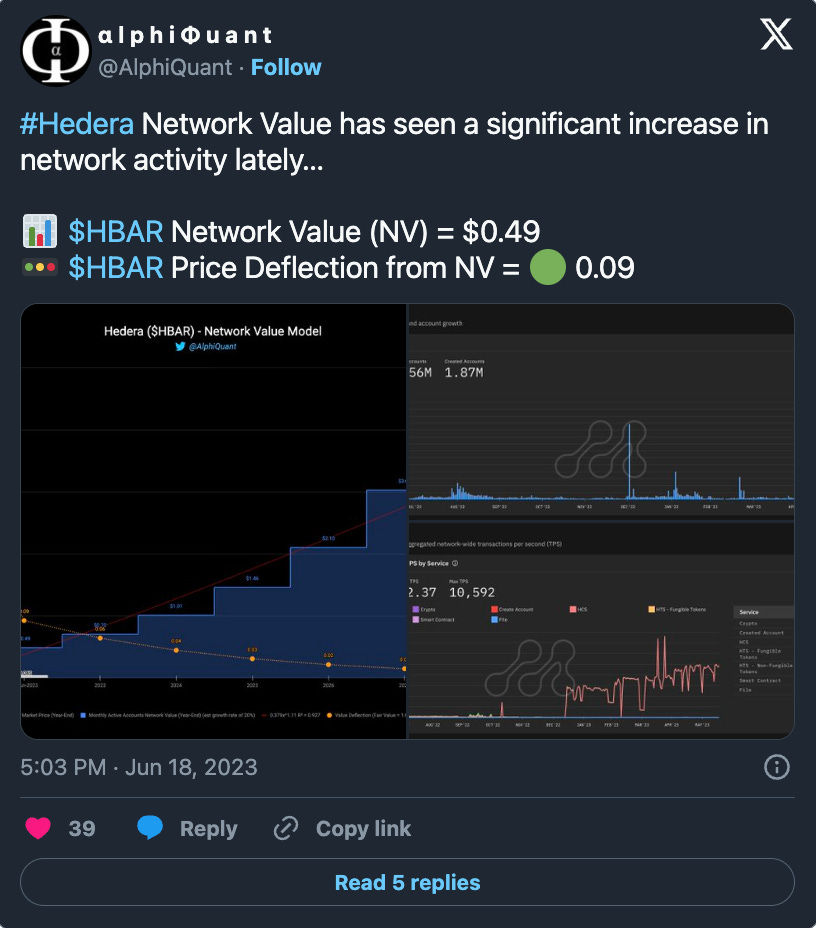

ℏedera Network Value Model (HBARUSD $0.49)

🚥 $HBAR Value Deflection = 🟢 0.11 (Fair Value = 1.00)

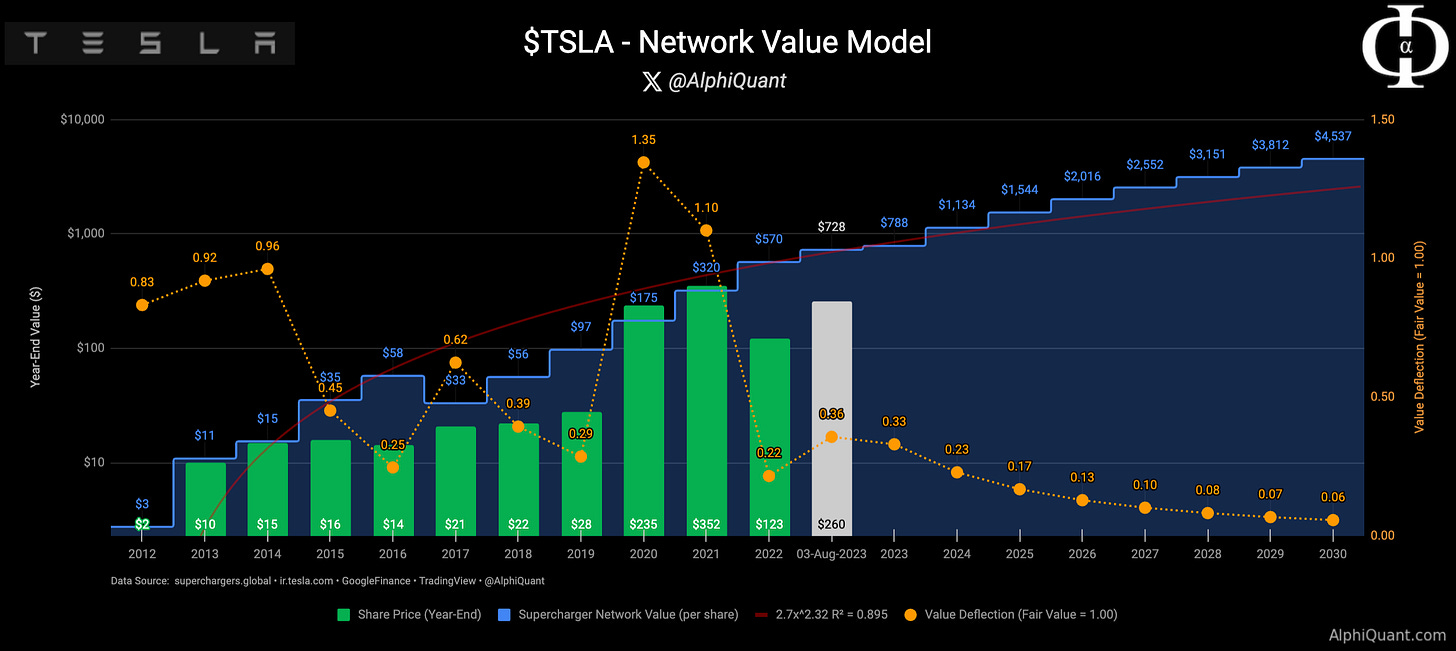

TESLA TSLA 0.00%↑

$TSLA Network Value Model ($728 per share)

🚥 $TSLA Value Deflection = 🟢 0.36 (Fair Value = 1.00)

$TSLA Logarithmic Trend Channel

$TSLA Market State

For further details about TESLA’s financial data science model check out the following post…

TESLA Financial Data Science Model

Network Value Model [Q2 2023] 📊 Supercharger Network Value = $729 per share ($2.3T market cap) 🔼 +13.2% from from Q1 2023 ($644 per share) 🚥 Value Deflection = 🟡 0.40 (Fair Value = 1.00) 🏷️ Tesla Q2 2023 Closing Stock Price = $291.26 ($912B market cap)

Apple AAPL 0.00%↑

$AAPL Network Value Model ($237 per share)

🚥 $AAPL Value Deflection = 🟡 0.81 (Fair Value = 1.00)

$AAPL Logarithmic Trend Channel

$AAPL Market State

Disclaimer

*** AlphiQuant publishes its research & analysis for purely educational purposes and is not licensed to provide financial advice nor is it registered with any financial regulatory body. Perform your own research and consult your financial advisor for investment advice. ***